- Email: [email protected]

- Call / WhatsApp Us: +91 70650 40985

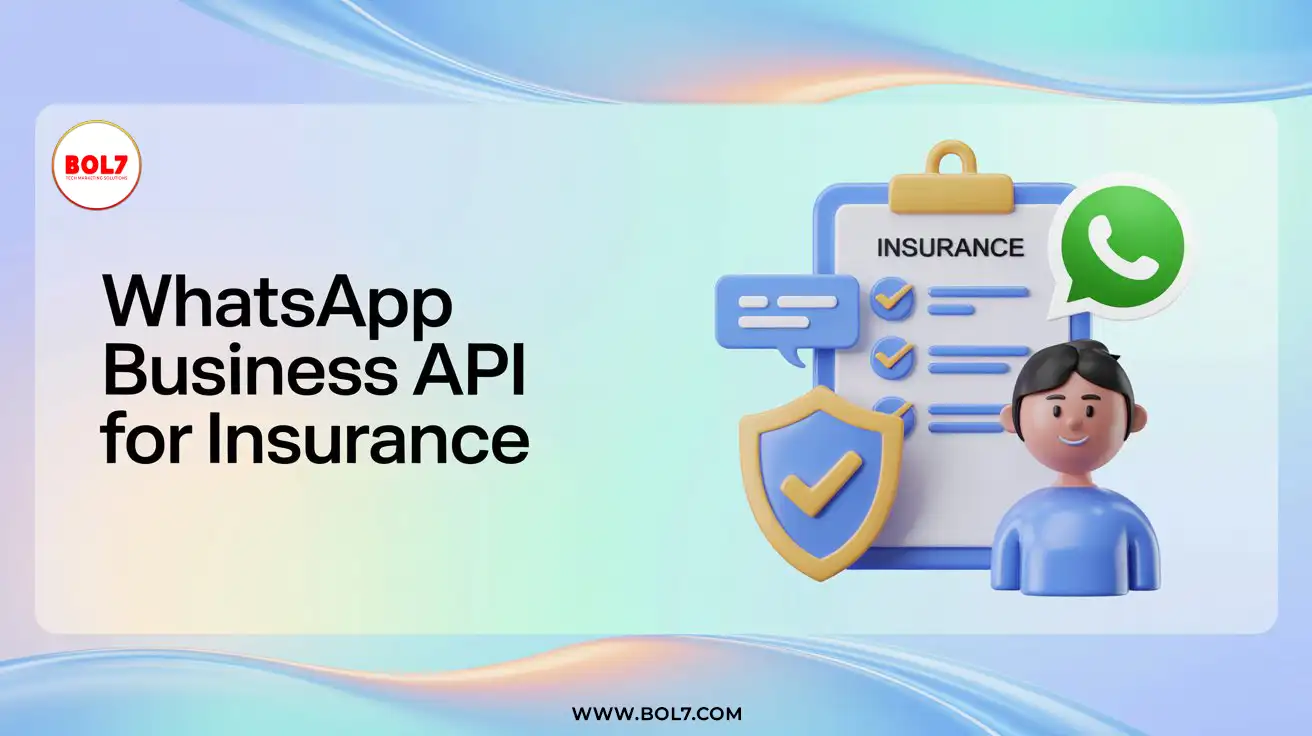

WhatsApp Business API for Insurance Companies: Automation, Security & Growth

The insurance industry is evolving rapidly as customer expectations shift toward instant communication, transparency, and digital-first service. Policyholders no longer want to wait on calls, chase emails, or visit branches for updates. They expect real-time responses, easy document sharing, and clear claim status updates — all on platforms they already use.

This is where WhatsApp Business API for Insurance is transforming the industry.

With WhatsApp’s massive user base, high engagement rates, and automation capabilities, insurers, brokers, agents, and TPAs can now deliver faster, more reliable, and more personalized communication across the entire insurance lifecycle.

What Is WhatsApp Business API for Insurance?

The WhatsApp Business API is an official, Meta-approved messaging solution built for medium and large businesses. Unlike the regular WhatsApp Business app, the API allows insurance companies to:

- Automate customer conversations

- Send bulk notifications securely

- Integrate WhatsApp with CRM, policy, and claims systems

- Use AI chatbots for 24×7 support

- Enable multi-agent customer service

- Ensure compliant, verified communication

For insurance companies, this means one secure platform to manage policy issuance, premium reminders, claims processing, renewals, and customer support at scale.

Why Insurance Companies Need WhatsApp Business API in 2026

Insurance communication is time-sensitive and trust-driven. Delays or miscommunication can lead to customer dissatisfaction, claim disputes, or policy lapses.

Common Challenges in Insurance Communication:

- Missed premium and renewal reminders

- High call center volumes

- Slow claims updates

- Manual document collection

- Repetitive customer queries

- Low engagement with email and SMS

WhatsApp Business API Solves These Problems By:

- Delivering messages instantly

- Automating repetitive workflows

- Enabling secure document exchange

- Providing real-time claim updates

- Improving customer trust and transparency

With 98% open rates, WhatsApp ensures that important insurance messages are actually read.

Key Use Cases of WhatsApp Business API for Insurance

1. Policy Issuance & Customer Onboarding

Insurance companies can automate onboarding by sending:

- Welcome messages

- Policy documents (PDFs)

- Policy numbers and coverage details

- KYC document requests

- Important terms and exclusions

This reduces onboarding time and eliminates manual follow-ups.

2. Premium Due & Renewal Reminders

Missed renewals result in policy lapses and revenue loss. WhatsApp API allows insurers to:

- Send automated premium due reminders

- Share renewal notices

- Provide secure payment links

- Send payment confirmations

This improves on-time payments and policy retention.

3. Claims Registration & Status Updates

Claims are the most critical touchpoint in insurance. WhatsApp Business API simplifies this process by enabling:

- Claim initiation through chat

- Automated collection of claim details

- Uploading photos, reports, and documents

- Real-time claim status notifications

- Approval or rejection updates

Customers stay informed at every step, reducing frustration and support calls.

4. AI Chatbots for Insurance Support

Insurance companies handle thousands of repetitive queries daily. AI-powered WhatsApp chatbots can answer:

- Policy coverage questions

- Claim eligibility

- Network hospitals or garages

- Endorsement processes

- Deductibles and benefits

- Policy validity checks

This reduces customer support workload by up to 60% while providing 24×7 assistance.

5. Secure Document Collection & Verification

Insurance involves extensive documentation. WhatsApp API enables:

- Secure upload of ID proofs

- Medical reports and invoices

- Vehicle inspection photos

- Accident reports

- Policy endorsement forms

All shared through end-to-end encrypted messaging.

6. Agent & Broker Communication

WhatsApp Business API is also powerful for internal insurance operations:

- Assign leads to agents

- Share sales updates

- Send commission statements

- Provide training updates

- Communicate product changes

This improves agent productivity and coordination.

7. Fraud Prevention & Authentication

WhatsApp API supports:

- OTP-based verification

- Secure identity confirmation

- Controlled access for agents

- Auditable message logs

This helps insurers reduce fraud and maintain compliance.

Benefits of WhatsApp Business API for Insurance Companies

- Faster Customer Communication

- Higher Engagement & Read Rates

- Reduced Call Center Costs

- Improved Claims Experience

- Automated Workflows

- Secure & Verified Messaging

- Better Customer Retention

- Scalable for Large Insurers

Insurance companies using WhatsApp automation deliver better service with lower operational costs.

WhatsApp vs SMS & Email for Insurance Communication

| Feature | WhatsApp API | SMS | |

|---|---|---|---|

| Open Rate | 98% | 20–30% | 10–15% |

| Automation | Advanced | No | Limited |

| Media Sharing | Yes | No | Limited |

| Read Receipts | Yes | No | No |

| Security | End-to-End Encryption | Low | Medium |

| Customer Engagement | High | Low | Low |

Compliance & Security in Insurance Messaging

Insurance companies handle sensitive personal and financial data. WhatsApp Business API ensures:

- Meta-approved messaging

- Opt-in-based communication

- End-to-end encryption

- Template approval for notifications

- Role-based access control

This makes WhatsApp suitable for regulated industries like insurance.

How to Get Started with WhatsApp Business API for Insurance

- Choose an official WhatsApp API provider

- Verify your business with Meta

- Activate your WhatsApp number

- Create approved message templates

- Integrate with CRM or policy systems

- Deploy chatbots and automation

- Start communicating with customers

Most insurance companies can go live within 24–48 hours.

Future of WhatsApp Business API in Insurance

In the coming years, insurers will increasingly use WhatsApp for:

- AI-driven claim assessments

- Personalized policy recommendations

- Predictive renewal reminders

- Conversational insurance sales

- Unified omnichannel support

WhatsApp is becoming the primary digital communication channel for insurance providers.

Final Thoughts

The WhatsApp Business API for Insurance is no longer optional — it is essential for modern insurance operations. From policy onboarding and premium reminders to claims processing and customer support, WhatsApp enables insurers to deliver faster, more transparent, and more reliable service.

Insurance companies that adopt WhatsApp automation today will gain a strong competitive advantage, build customer trust, and improve operational efficiency in 2026 and beyond.

⭐ FAQs: WhatsApp Business API for Insurance

"This article explains how WhatsApp Business API is transforming the insurance industry by automating policy communication, premium reminders, claims processing, document sharing, and customer support—helping insurers improve efficiency, trust, and customer experience."

Blog Comments (0)

Leave a Reply

Categories

- Performance

- Pay Per Click

- Search Engine Optimization

- Digital Marketing

- Advertising

- Election Management

- Technology

- Social Media Marketing

- Business Data Solutions

- Artificial Intelligence & Automation

- Security

- Colocation Services

- Company Registration UAE

- WhatsApp Business API

- Digital Tools

- Business Messaging

- Business Communication

Recent Post

Popular Categories

Related Blogs & Article

Learn what a WhatsApp Business API provider in India does, how pricing works, key features to check, common mistakes to avoid, and how to choose a reliable partner for 2026.

This guide explains what a WhatsApp Business API provider in India does, pricing models, use cases, compliance, and how businesses can choose the right provider for scalable growth in 2026.

Compare the top 10 WhatsApp Business API providers in 2026. Explore features, pricing, automation tools, support quality, and integrations to choose the right BSP.

WhatsApp Business API pricing is based on conversation types, not messages. This guide explains message costs, setup fees, free conversations, and how businesses can calculate and optimize WhatsApp API pricing effectively.

clear and complete guide to WhatsApp Business API documentation, covering Cloud API, message templates, pricing, webhooks, onboarding, and best practices for businesses.

The WhatsApp Business API helps stock brokers automate client communication, deliver instant trade alerts, simplify onboarding, and enhance customer experience. This guide explains features, use cases, benefits, automation, and best practices for brokers.

The WhatsApp Business API helps schools, colleges, and EdTech companies automate admissions, student communication, attendance alerts, fee reminders, and learning workflows. A complete 2026 guide for modern education.

WhatsApp Business API helps tax advisors, CA firms, and accounting professionals automate GST and ITR reminders, document collection, client onboarding, and payment follow-ups. A complete 2026 guide for transforming financial communication.

WhatsApp Business API helps automotive and automobile businesses automate leads, test drives, financing, and after-sales service. Boost sales, improve customer experience, and streamline communication with AI-powered automation in 2026.

Ready To Take Your SEO To The Next Level

Effective SEO strategies not only elevate a website's visibility but also drive targeted traffic, enhance user experience.

Simplify policy onboarding, automate premium reminders, manage claims updates, and provide 24×7 customer support using WhatsApp Business API. Get started with Bol7 today.

Buy NowUseful Links

Get In Touch

[email protected]

+91 70650 40985

- live:hemant_136

A-27J, Noida Sec 16, Gautam Buddha Nagar, Uttar Pradesh 201301

Stay connected & Informed

Join our WhatsApp Channel

ⓒ 2024 BOL7 All Rights Reserved